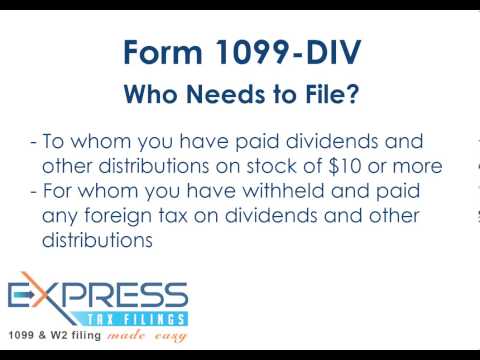

The form 1099 Div is an annual tax statement provided to investors by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. This form includes income from dividends, including capital gains dividends and exempt interest dividends, over $10. The due date for paper filing Form 1099 Div is February 28th, 2014. If you choose to e-file the Form 1099 Div, the due date is automatically extended to March 31st, 2014. Please keep in mind that recipients must be provided a copy by January 31st. The Form 1099 Div for dividends and distributions must be filed for each person to whom you have paid dividends and other distributions on stock of $10 or more, or anyone for whom you have withheld and paid any foreign tax on dividends and other distributions on stock, or for whom you have withheld any federal income tax on dividends under the backup withholding rules. Finally, it must be filed for anyone to whom you have paid $600 or more as part of a liquidation. The IRS encourages e-filing for these information returns and mandates that anyone filing 250 or more must file these returns electronically. To learn more about how you can e-file your information return, such as a Form 1099 Int, with the IRS, you can go to expresstaxfilings.com, an IRS authorized e-file provider. If you have any questions, you can contact our support team from our headquarters in Rock Hill, South Carolina at (704) 839-2270 or send us an email at support@expresstaxfilings.com.

Award-winning PDF software

Video instructions and help with filling out and completing Are 990 Schedule R 2025