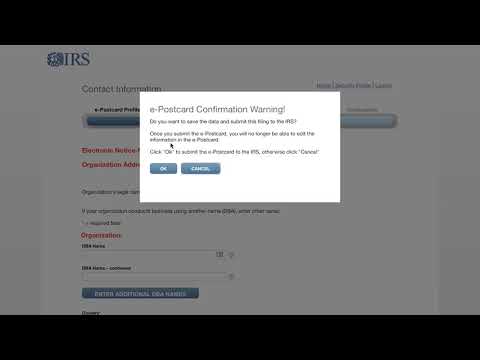

Hi, it's Christian. To file your Form 990-N information return, or essentially, what is your tax return for a nonprofit that is pulling in a total of $50,000 or less in revenues in a given tax year, you have to create an e-Postcard profile. They still call this the e-postcard, even though it's done online now. So, we're going since we're doing our own and we're not acting as a preparer in this particular case. We are going to select exempt organization and hit continue. Then, we grab our I am and add that to our profile. Next, we're going to select create new filing and hit continue. Now, we're going to answer a couple of simple questions. Have we been terminated or gone out of business? The answer is no. Were we less than $50,000? We are going to verify that the answer is yes and then continue. You can add DBA names if you have any. Here, we're just going to quickly go through because of identity fraud, etc. So, I always default to using the organization's address that I want to submit this data and file to the IRS. The answer is yes. I have now completed the filing of my Form 990-N, also known as the information return, which is really a replacement for a tax return for a tax-exempt organization. I highly recommend you print a copy of the filing when you're done because it allows you to capture this information in the middle of the screen. So, you have some proof that you were, in fact, filed. What I'm going to do here is I'm going to go up to the print dialog and it might look slightly different if you have a Windows computer. I'm going to save this as a PDF and...

Award-winning PDF software

Video instructions and help with filling out and completing Fill 990 Schedule Requirements