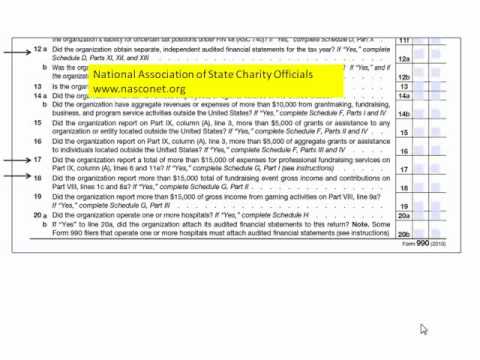

Part four of the 990 is a checklist of required schedules, and it is actually two pages long, so I'm not going to go over everything that's there. But I do want to point out a few things that people find interesting or could be particularly informative. For example, line four asks if the organization is a Section 501(c)(3) organization, which is a charitable organization. Because this is a 990, did the charity engage in lobbying activities? If they answer yes, they need to complete Schedule C, Part II. Charitable organizations are allowed to engage in lobbying activities, but there are limits. The IRS wants to be sure that their lobbying activities aren't overwhelming or taking too great a proportion of their energies or resources, and diverting resources from carrying out their charitable mission. Another thing people are interested in is audited financial statements. We will get calls all the time from people asking, "Do non-profits have to release their audited financial statements?" The answer is, well, there is no requirement from the IRS. That's not one of the documents the IRS says is a public document. The public documents are the application for exemption, the letter of determination, which is the letter the IRS sends saying your application for exemption has been granted, your organization is now tax-exempt under Section 501(c) whatever, and the three most recent annual returns, which is the 990 or variation thereof that the organization has filed. Nowhere in there are independent audited financial statements. But if the organization does have an independent audit of the financial statements and they click yes, then they need to fill out a Schedule D or a section of Schedule D. Some states actually require nonprofits to send them copies of their audited financials as part of their reporting...

Award-winning PDF software

Video instructions and help with filling out and completing Where 990 Schedule Requirements