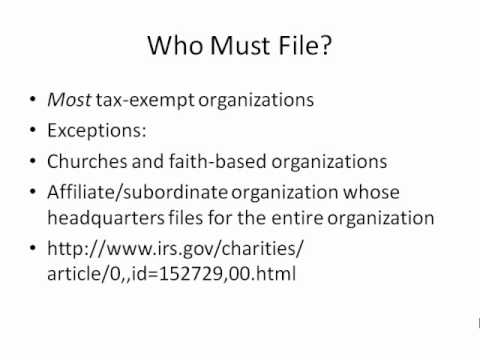

So who must file the 990? Most tax-exempt organizations. That is, most organizations that apply for and receive tax-exempt status from the IRS. There are some exceptions, however, and one of the most common ones is churches and faith-based organizations run by churches. These organizations are automatically tax-exempt and they are not required to apply for tax-exempt status nor are they required to file a 990. Although some of them do voluntarily. Another example might be a subordinate organization. Then you have a large national regional organization that has a number of affiliates. If the national or regional headquarters fills out a 990 that includes information on all of the affiliates, then the affiliates don't have to file because they have already been reported on by the headquarters. Yeah, there are other organizations and you can find the list of organizations, types of organizations that are not required to file IRS Form 990 on the IRS website at IRS.gov/charities/article/?ID=152729.html. - So, of the hundreds of thousands of organizations that do file an annual return, who files what? If the organization is a 501(c)(3) private foundation, that is an organization like the Bill and Melinda Gates Foundation, the Ford Foundation, the Rockefeller Brothers Fund, the Kellogg Foundation, and their hundreds, not thousands, of smaller ones. Does it matter what size it is? It must file a Form 990-PF. And we do have 990s on GuideStar for all of the other tax-exempt organizations that are required to file. Their size, determined by assets or budget, determines rather they need to file. If the organization's annual gross receipts are normally less than fifty thousand dollars or equal to fifty thousand dollars, they file a very short form known as Form 990-M. That is not on GuideStar because all of the information and it is...

Award-winning PDF software

Video instructions and help with filling out and completing Who 990 Schedule Requirements